Did you know the U.S. has over 90 million iPhone users? Apple’s flagship device has led to the Apple Card. This credit card blends technology with finance for a great experience. We’ll show you how to get your Apple Card, covering the application, who can apply, and its perks. Let’s dive into Apple Card and see how it changes your finances.

Introducing the Apple Card

The Apple Card is a groundbreaking credit card that makes financial experiences easier. It blends technology with the ease of a credit card. This gives users a smooth and secure way to handle their money.

What is Apple Card?

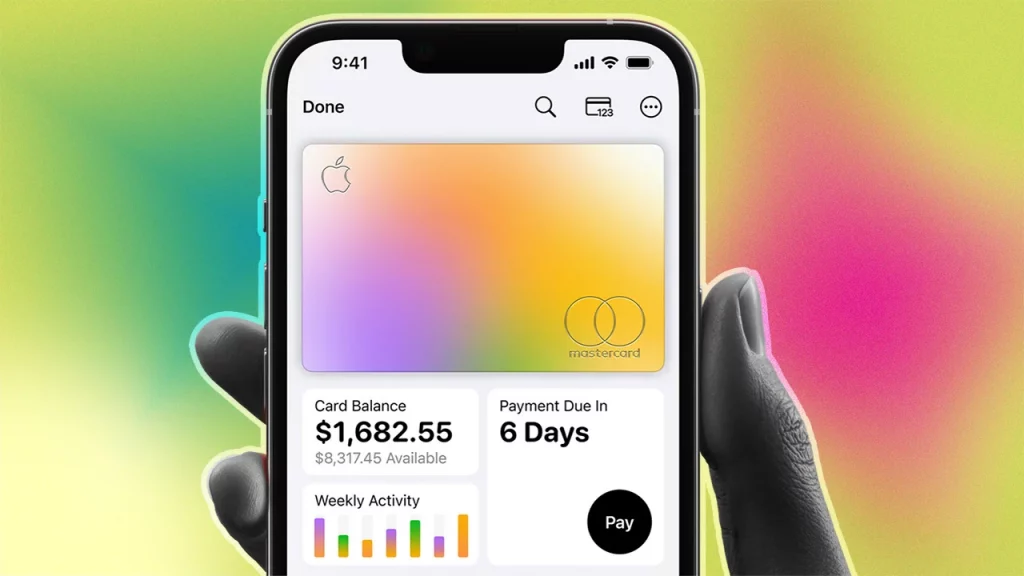

The Apple Card, offered by Apple, works both digitally and physically. It’s a Mastercard accepted everywhere Mastercard is. Integrated with the iPhone Wallet app, it helps users manage their card easily. They can check balances, see transactions, and pay right from their phone.

Apple Card stands out with daily cash back, no annual fees, and clear interest rates. Plus, it’s made of titanium for a stylish look.

The Integration with iPhone and Wallet App

Apple Card works perfectly with iPhones and the Wallet app. The Wallet app helps users handle their Apple Card finances securely and conveniently.

Users can track spending, look at statements, and sort expenses with the Wallet app. It also offers insights on interest and payments. This makes dealing with money easy for all Apple Card holders.

Moreover, the Wallet app has extra features for a better Apple Card experience. It lets users get notifications, adjust card settings, and request a physical titanium card for use.

Built-in Privacy and Security

Privacy and security are key to the Apple Card. Apple uses advanced security to keep user data safe. The card checks transactions with Touch ID and Face ID. This means only the user can use the card.

Each purchase has a unique security code for added fraud protection. The card doesn’t keep transaction details on Apple servers or with third parties. This ensures user financial information stays private.

The Apple Card brings a secure and simple way to manage money. Its easy use with iPhones and the Wallet app makes finance management safer than ever.

Advantages of Using Apple Card

Apple Card offers many perks, making managing finances easier. You get daily cash back, no extra fees, and insights into interest and payments. These features help you handle your money better.

Daily Cash Back Rewards

Apple Card’s daily cash back feature stands out. Every purchase with Apple Card earns you cash back. This cash goes to your Apple Cash card. You can spend it, send it, or move it to your bank. This way, you save money on what you buy.

No Fees Structure

Apple Card doesn’t charge common fees. This includes annual fees and fees for foreign buys. You won’t pay extra for using it here or abroad. There are no late fees, but paying on time is still crucial for your credit score.

Interest Rate Insights with Payments

Apple Card shows interest rates and payments in the Wallet app. It shows how paying different amounts affects interest. This helps you make smart choices about paying off your balance. You can aim to get out of debt faster.

Choosing Apple Card means enjoying these benefits. You get more from your financial actions and keep expenses in check. With its rewards, no fees, and payment insights, it’s a great financial tool.

Apple Card’s Unique Features

Apple Card has some unique things that make it different from usual credit cards. These features make using the card better and offer great benefits. Let’s dive into two key features: unlimited daily cash back and the titanium material.

Unlimited Daily Cash: Understand the Benefits

Apple Card is known for its unlimited daily cash back. This means you earn money back with every purchase. Unlike other cards, there’s no limit to how much cash back you can get.

With the Daily Cash feature, cash back goes straight to your Apple Cash card. You can use this cash to pay off the Apple Card or shop with Apple Pay. This lets users get the most out of their purchases, with no limits.

Apple Card Titanium: A New Kind of Credit Card Material

Apple Card is also unique because it’s made of titanium. This material is strong and good for the environment. It gives Apple Card a high-quality feel, different from regular plastic cards.

Titanium’s durability means your Apple Card stays looking good. And since titanium is recyclable, it’s a green option. This shows Apple’s commitment to being eco-friendly.

The card has a special design too. It’s laser-etched with your name, adding a personal touch. Its minimalist design and metallic look make it stylish.

The Apple Card stands out with unlimited daily cash back and titanium material. It offers a unique and improved card experience. Apple Card is more than an ordinary credit card, thanks to these innovative features.

How to Apply for Apple Card

Step-by-step Application Process

Getting your Apple Card is simple and straightforward. Just follow these steps to apply:

- Open the Wallet app on your iPhone

- Tap on the “+” button to add a new card

- Select Apple Card from the list of available cards

- Fill in your details, including name, date of birth, and contact info

- Agree to the terms and conditions

- Check your application summary carefully

- Tap “Submit” to finish your application

After you submit, Apple will check your details. You’ll then get a message about your eligibility. If you’re approved, the Apple Card goes right into your Wallet app. You can start using it at once.

Eligibility Criteria for Applicants

To apply for Apple Card, certain criteria need to be met. You should:

- Be at least 18 years old

- Be a U.S. citizen or a lawful resident with a U.S. address

- Use an iPhone with the latest iOS

- Have a compatible iCloud account

- Meet Goldman Sachs’ credit and income requirements

This makes sure you’re qualified to apply for and use the Apple Card.

Applying for an Apple Card is quick and easy with your iPhone. By following the steps and meeting the criteria, you can enjoy all the benefits of the Apple Card.

Apple Card Family: Sharing Financial Responsibility

Apple Card Family lets you share your Apple Card with trusted friends or family. This way, you can combine credit lines and build credit together. It’s a great way to handle money and shared expenses easily.

Merging Credit Lines with Partners

With Apple Card Family, inviting someone to share your Apple Card is simple. When you merge credit lines, you both use the shared Apple Card. This makes tracking and managing money easier, especially for bills and joint buys.

Building Credit Together: How It Works

Sharing your Apple Card can boost both of your credit scores. Just use the card wisely and pay on time. This teamwork in finance can lead to better credit scores and more credit opportunities later.

Apple Card: Learn How to Order Today

To get your Apple Card, just follow a few simple steps. These steps unlock many benefits and features for you.

- Open the Wallet app on your iPhone (iPhone integration).

- Tap the ‘+’ button to add a new card.

- Select ‘Apple Card’ from the available options.

- Fill in your personal details and verify your identity.

- Review the terms and conditions, then accept the offer.

- Wait for approval (application process).

- Once approved, your Apple Card will be added to your Wallet app.

- You can start using your Apple Card immediately for purchases, both in-store and online.

Remember, Apple Card might not be available to everyone. It depends on where you live and your credit history. Before you apply, check what’s needed for your area.

If you can’t get an Apple Card now, there’s no need to worry. There are other ways to enjoy the perks of Apple Pay. Look for different credit cards or digital wallets that work with Apple Pay. This way, you can still make safe and easy payments.

Earn and Use Daily Cash with Apple Card

Apple Card has a great daily cash back program. You get cash rewards for your purchases. So, you earn money by just using your card.

Get Daily Cash on Purchases

Buying something with Apple Card gets you daily cash. How much you get back depends on where you shop. For instance, get up to 3% back on Apple stuff, 2% using Apple Pay, and 1% with the physical card.

Check your rewards in the Wallet app under Apple Card. You’ll see your daily cash and keep track of what you’ve earned.

Daily cash goes to your Apple Cash card quickly after you buy something. Use it right away, move it to a bank, or send it to others in Messages.

Using Daily Cash for Various Transactions

Apple Card’s daily cash is flexible. You can use it in many ways, which is pretty handy.

Here are ideas on how to use your daily cash:

- Lower your bill by applying it to your statement balance.

- Get a gift card to popular places.

- Send it to people through Messages.

- Pay with it using Apple Pay.

- Move it to your bank for anything you need.

Apple Card makes accessing and using your earnings simple.

Managing Your Apple Card Account

It’s simple to manage your Apple Card with the Wallet app. You can check how much you owe, make payments, and find out about monthly plans and tracking your financial health. Learn about the easy tools that help you keep your money in order.

Checking Balances and Payments in Wallet App

Use the Wallet app to easily check your Apple Card’s balance and look at your spending. Just open the app and go to the Apple Card section. There you can see your current balance, how much credit you have, and your latest purchases.

It’s important to check your balance often to stay on top of your finances. Knowing what you spend helps you make smarter choices with your money. This way, you can use your credit wisely and keep your finances healthy.

The Wallet app also makes paying off your Apple Card easy. You can pay anytime from your iPhone, either setting up automatic payments or paying manually. This helps you keep up with payments and avoid any late fees.

Accessing Monthly Installments and Financial Health

The Apple Card lets you pay for big purchases over time without interest through monthly installments. In the Wallet app, there’s a special area to see and manage these monthly plans.

This feature lets you check your ongoing plans, see how you’re doing, and pay them off. It makes it easier to handle your budget and prevents having to pay everything at once.

Besides, the Wallet app offers insights into how you spend your money. It summarizes your spending, categorizes it, and gives tips for better financial health. With these tools, you can understand your spending better and reach your financial goals.

managing Apple Card account

Apple Card Monthly Installments

Apple Card Monthly Installments let you buy Apple products without paying interest. Want a new iPhone or Apple Watch? This plan makes it easy to manage your money.

You can spread the cost over months. This way, buying your favorite products doesn’t feel like a big hit to your wallet. It’s flexible and doesn’t need upfront payment.

Interest-free Purchases at Apple

This plan means no extra fees when buying. You get Apple gadgets without the scare of interest. Apple makes it easier on your budget this way.

Be it a new iPhone or iPad, interest-free helps keep costs down. It makes tech dreams affordable, without messing with your finances.

Managing Installments in Wallet App

Tracking your payments is easy with the Wallet app. It shows your balance, due dates, and more. Everything you need, all in one place.

Pay off your balance in the app too. Whether early or on schedule, it helps build a good credit score. Plus, automatic payments mean one less thing to worry about.

| Benefits of Apple Card Monthly Installments | Process |

|---|---|

| Interest-free purchases | 1. Select your desired Apple product 2. Choose Apple Card Monthly Installments as the payment option 3. Review the installment details 4. Confirm and complete your purchase |

| Flexible payment plans | 1. Access the Wallet app 2. View your payment plans 3. Make payments towards your installments 4. Track your remaining balance and payment due dates |

| Convenient management | 1. Set up automatic payments 2. Make early payments to reduce your balance 3. Receive reminders for upcoming payments 4. Monitor your payment history |

Maximizing Benefits with Apple Pay and Apple Card

Apple Pay and Apple Card offer many benefits for your financial tasks. They give valuable rewards and are accepted almost everywhere.

2% Daily Cash with Apple Pay

Using Apple Pay with your Apple Card can get you daily cash rewards. You get 2% back on what you spend with Apple Pay. So, every payment also brings you cash rewards.

Whether it’s groceries, gas, or a new gadget, Apple Pay gives you rewards on every buy. This way, you save and earn money easily every day.

Universal Acceptance of Apple Card

The Apple Card is accepted worldwide. Use your card in stores, online, or when you’re abroad with ease.

More stores and services are choosing Apple Pay for its security. The Apple Card makes purchasing straightforward, no matter where you are.

Privacy and Security: The Apple Way

Privacy and security are top priorities for the Apple Card. Apple has strong measures in place to keep user info safe. This ensures customers have a secure financial experience.

Your personal data is kept private with Apple Card. The details you share when applying are stored safely and kept secret. Apple makes sure not to sell your data, keeping your financial details private.

With Apple Card, your transactions are safe and encrypted. Apple uses top security measures to protect your financial data. This reduces the risk of anyone accessing your info without permission.

Apple Card also has special data protection features. Every purchase gets a unique identifier. This restricts how much info merchants get, protecting your details.

For online shopping, Apple Card uses a one-time security code. This code changes every time you buy something. It adds an extra layer of security against fraud.

The Apple Card Wallet app adds more security. It lets you watch your account and get alerts for suspicious activity. If something’s wrong, Apple’s team is there to help right away.

Choosing Apple Card means trusting Apple with your financial safety. They put your privacy and security first, offering a trustworthy credit card experience.

Strengthening Financial Acumen with Apple Card

Apple Card gives users tools and features to grow their financial skills and make smart money choices. By using these resources, people can understand their spending habits and how it affects their credit. This improves their ability to manage money well.

Tools for Tracking Expenses

Keeping an eye on spending is critical in managing finances. Apple Card helps users track their expenses with easy-to-use tools in the Wallet app. People can easily see where their money goes. This helps them look at their spending habits and adjust to reach financial goals.

Understanding Credit Implications

Understanding how your money choices affect your credit is vital. Apple Card provides insights into these credit impacts. It gives access to credit use and payment history. This lets individuals see how their actions influence their credit score and financial health.

Apple Card combines expense tracking and credit insights to boost financial understanding. Users can make wise money decisions, keep track of spending, and have a solid credit score.

| Benefits of Apple Card for Financial Acumen | Explanation |

|---|---|

| Expense Tracking | Gain insights into spending habits and make informed financial decisions based on tracked expenses. |

| Credit Implications | Understand how financial actions impact credit score and overall financial health. |

Conclusion

The Apple Card offers many benefits and features. These can greatly improve how you manage your money and give you good rewards. Its easy use with the iPhone and Wallet app lets you handle payments smoothly. You also get strong privacy and security.

You get daily cash back rewards with the Apple Card. This card has no fees and helps you understand interest rates and payments better. This way, you can make smarter financial choices.

It’s easy to apply for the Apple Card. Once approved, you can enjoy extra options. For example, the Apple Card Family lets you share your card with family or friends. This can help everyone manage money better. Using the Wallet app, you can check your balance, pay bills, and keep an eye on your financial health.

By getting your Apple Card today, you’ll start seeing its benefits. Enjoy the ease, security, and rewards it brings to your money matters.